Outsourced bookkeeping servicesBlogs and Insight

We understand the importance of accurate and efficient bookkeeping services for businesses. Our team of experts uses advanced tools and technologies to manage financial transactions, while providing comprehensive statements and reports to support informed decision-making. We tailor our bookkeeping services to meet the unique needs of each client, ensuring that their financial operations are streamlined and optimized for success.

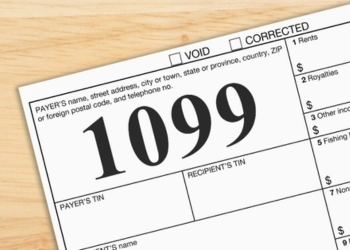

1099-NEC vs 1099-MISC: Everything CPA Firms Must Know for 2026

February 28, 2026

Managing Tax Season for CPA Firms: A Practical Operational Guide

September 22, 2025

Why Tax Season is becoming a Data Validation Season for Accounting Teams

September 20, 2025

Why Accurate 1099-NEC Filing Is Critical for the 2026 Tax Season

September 19, 2025

Top 5 Reasons Smart CPA Firms Are Partnering with a CAAS Company

September 18, 2025

In-House vs Outsourced Ecommerce Bookkeeping: What’s Best for Your Clients?

September 16, 2025

The Future of a Small Company Accountant: Leveraging Outsourcing for Growth

September 13, 2025

Best Accounting Firms for Small Business: Key Services You Should Expect

September 12, 2025

How to Do Business Taxes and Know When to Outsource

September 11, 2025

Confused between 1099 and W-2 Forms? Here’s the Difference!

September 8, 2025

What is the US Hire Act Bill 2025? Understanding the Ramifications!

September 6, 2025

Top Five Accounting Outsourcing Trends to Watch Out For in 2025

September 2, 2025

Better Financial Management with Outsourced Wholesale Accounting

September 1, 2025

How Outsourced LLC Accounting Can Benefit Small Business Owners

August 30, 2025

All You Need to Know About Outsourced Healthcare Accounting

August 28, 2025

Why Cash Flow Forecasting Should Be on Every CFO’s Radar

August 25, 2025

The Crucial Role of Cybersecurity for Accounting Firms

August 23, 2025

5 Accounting Trends That Are Shaping the Future of Accounting

August 18, 2025

Global Outsourcing Insights: Understanding the $100K H-1B Impact

August 16, 2025

OBBB 2025: Trump Accounts and Personal Tax Reform

August 13, 2025

IRS on Cryptocurrency Tax: Key Insights for 2025

August 11, 2025

Restaurant Accounting: Best Practices & Top Tools

July 24, 2025

Legal Tax Strategies Every Small Business Should Know

June 10, 2025

Child Tax Credit: A Guide for Accountants

June 7, 2025