Optimizing Tax Preparation for U.S. Accounting Firms in 2025

increasing, and the demands on CPA firms are growing like never before. U.S.-based accounting firms remain in a critical position regarding tax preparation, which is often tedious and time-intensive. Today, firms must excel in navigating intricate tax codes and providing strategic financial guidance. However, the repetitive nature of tax preparation can divert focus from core advisory services.

This blog explores the benefits and nuances of outsourced tax preparation services tailored explicitly for U.S.-based accounting firms in 2025. We will examine the key services these outsourced firms provide. We shall also analyze why India remains the preferred outsourcing destination, surpassing other options like the Philippines.

The Challenges Brought on By Tax Season

In 2025, tax season remains one of the most demanding periods for CPA firms across the United States. However, these firms are well-versed in tax laws. However, the sheer volume of work during this time can be overwhelming. Besides calculations, it involves extensive data entry, verification of documents, and assurance of compliance with the ever-changing tax regulations. All this requires significant time and effort.

Also Read: Best Tax Preparation Practices for USA Businesses

Additionally, tax season often coincides with financial reporting deadlines, creating added pressure on firms to juggle multiple responsibilities. Additional responsibilities like this could create serious consequences that toll your CPA firm. Also, long hours and stressed teams reduce the capacity to focus on high-value financial advising and strategic planning services.

Why Outsourcing is a Strategic Move in 2025

Amid ongoing challenges like this, outsourcing tax preparation is becoming an increasingly attractive solution. Rather than shifting responsibilities, outsourcing helps optimize them. Delegating repetitive tax preparation to specialized firms allows CPA firms to free up valuable internal resources. This move helps them concentrate on core competencies and provides clients with high-level financial advice and solutions.

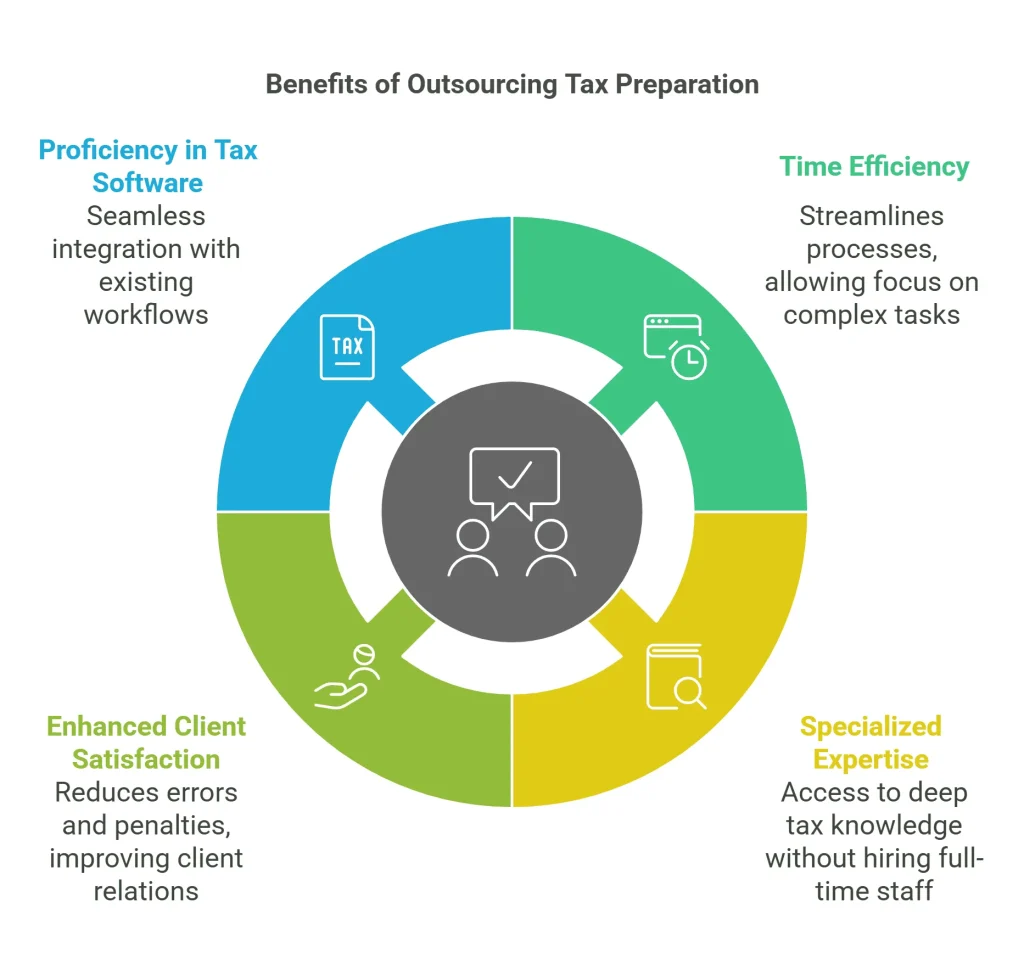

Key Benefits of Outsourced Tax Preparation

Time Efficiency:

The fast-paced tax season poses several challenges for CPA firms. Mounting deadlines may cause efficiency issues and confusion. Outsourcing tax preparation can significantly reduce the burden of handling routine yet time-consuming tasks. This move allows in-house teams to focus on more complex and strategic work. Hence, CPA firms can ultimately improve client service and business growth.

Access to Specialized Tax Expertise:

Tax laws continue to evolve in 2025. This makes it crucial for CPA firms to stay updated. Outsourced tax firms like KMK work with various CPA firms and serve clients from different industries. As a result, they develop deep expertise in tax preparation for individuals and businesses. Partnering with an outsourcing provider enables CPA firms to access this specialized knowledge without hiring additional full-time tax specialists.

Enhanced Client Satisfaction:

On the one hand, CPA firms strive to maintain high accuracy in tax filing, while on the other, the sheer workload during peak season increases the likelihood of errors, even if they are minor. Such slip-ups can lead to delays and client dissatisfaction. In some cases, they may also lead to financial penalties. Contrarily, outsourced tax firms are dedicated solely to tax preparation. They can implement strict quality control processes to ensure accuracy and compliance.

Additionally, firms like KMK stay updated with the latest tax regulations, which minimizes the risk of non-compliance due to outdated information. Their expertise serves as an additional review layer, ensuring tax filings are accurate and complete. Besides, they also ensure that these tax filings are fully compliant with current laws.

Proficiency in Advanced Tax Software:

One of the most significant advantages of outsourcing tax preparation to specialists like KMK is their proficiency in various tax software platforms. In 2025, firms like KMK continue to train their staff in leading tax software such as Intuit ProConnect, Lacerte, UltraTax, Drake, and CCH Axcess, along with practice management tools like TaxDome and Canopy. With this expertise, outsourced professionals can seamlessly integrate with CPA firms’ existing workflows, ensuring smooth collaboration.

Key Tax Services Provided by Outsourced Firms

Outsourced tax professionals can handle a wide range of tax preparation services. This enables CPA firms to expand their service offerings. Below are some of the key tax returns that outsourcing firms can assist with:

- LLC & Partnership Tax Returns– Form 1065

- Preparation of Form 1065 for LLCs and partnerships

- Accurate allocation of income to partners

- Preparation of Schedule K-1 and tracking basis adjustments

- C Corporation Tax Returns – Form 1120

- Preparation of Form 1120 for C Corporations

- Books-to-tax adjustments and preparation of M-1, M-2 & L schedules

- Assistance with Forms 5471 & 5472 for foreign reporting

- S Corporation Tax Returns– Form 1120S

- Preparation of Form 1120S for S Corporations

- Detailed preparation of shareholder schedules

- Assistance with review work papers & tax schedules

- Trust Tax Returns– Form 1041

- Identification of trust types and corresponding tax obligations

- Accurate preparation of Form 1041

- Individual Tax Returns– Form 1040

- Preparation of Form 1040, including income sources, deductions, and credits

- Managing W-2s, 1099s, and estimated tax payment records

- Ensuring tax returns are error-free before filing, reducing review time for CPA firms

By outsourcing these services, CPA firms can ensure timely and accurate tax filings while focusing on providing higher-value services to their clients.

Why India Continues to Lead Over the Philippines in 2025

When it comes to tax preparation outsourcing, India remains the top choice over the Philippines due to several key factors:

Superior Quality of Work:

India has a long-standing reputation for providing high-quality outsourcing services in the financial and tax domains. Firms in India implement rigorous quality control measures, ensuring accuracy and compliance. The country’s outsourcing industry has matured significantly, with well-established protocols that minimize errors. Conversely, while the Philippines offers outsourcing solutions, the tax preparation industry there is less developed, leading to potential inconsistencies in quality.

Highly Skilled Talent Pool:

India continues to be home to over 2.5 million finance and accounting professionals, including many Chartered Accountants (CAs) and Certified Public Accountants (CPAs). Additionally, India produces over 200,000 new finance graduates annually, ensuring a steady stream of skilled professionals. By contrast, the Philippines produces approximately 10,000 finance graduates annually, making finding a large pool of specialized tax professionals more challenging.

Time Zone Advantage & Faster Turnaround:

India’s time zone remains a significant advantage for U.S. CPA firms. With a 9 to 12-hour time difference, Indian outsourcing teams can work on tax preparation overnight while U.S. firms focus on client-facing activities during the day. This “follow-the-sun” model enables faster turnaround times and seamless workflow management.

We at KMK work from 4.30 am EST to 1.30 pm EST, so considerable overlap exists between the time zones in India and the USA. Our response time to emails and other queries is generally less than 24 hours. In comparison, the Philippines often requires professionals to work entire night shifts to match U.S. business hours, making it less sustainable for long-term outsourcing success. The demanding work schedules in the Philippines can lead to high attrition rates and inconsistent service levels.

Conclusion: The Future of Tax Preparation in 2025

- As CPA firms navigate the complexities of tax preparation in 2025, outsourcing continues to be a game-changer. By partnering with firms like KMK, CPA firms can:

- Streamline tax processes

- Gain access to top-tier tax expertise

- Enhance client satisfaction

- Reduce errors and ensure compliance

- Leverage global talent for faster turnaround

India remains the premier destination for tax outsourcing, offering unmatched talent, quality, and efficiency. As the industry evolves, CPA firms that embrace outsourcing will position themselves for long-term success, efficiency, and profitability in an increasingly competitive market.

At KMK, we specialize in providing top-tier tax preparation services tailored to the needs of CPA firms. With a team of 1000+ seasoned professionals spanning both the USA and India, we deliver high-quality, secure, and efficient tax solutions. Our expertise in cutting-edge tax software ensures seamless collaboration with CPA firms, allowing them to scale their operations confidently. By choosing KMK, you’re not just outsourcing tax preparation; you’re partnering with a firm dedicated to helping CPA firms thrive in 2025 and beyond. Want to optimize your tax preparation strategy? Contact KMK today!

USA:

651 N Broad St Suite 205, Middletown, DE 19709, USA

Phone: 310-362-2511

India:

300, Sankalp Square-3B

Sindhu Bhavan Marg,

Ahmedabad, Gujarat 380058

For Career: 91-98240-42996

Developed by Bluele | Copyright © 2026 | KMK Ventures Private Limited. | All Rights Reserved