Tax Planning for Small Businesses: Strategies for 2025

If you are a small business owner, then your first priority is running a successful enterprise. However, you should also understand that managing your finances and taxes are just as critical. Now that it is time to finalize your return, it is the perfect time to start planning ahead.

At this point, it is worth mentioning that the IRS (Internal Revenue Service) does not typically pose a major concern for most tax payers because their tax filings are relatively straightforward. However, business owners often receive more attention or scrutiny from the IRS due to the complexity of their tax situations, such as multiple income sources, deductions, and compliance requirements. Recent data suggests that the IRS issued millions of notices for mathematical errors on tax forms. This highlights the importance of accuracy and proactive planning.

What is being suggested here is that as a small business owner it is advisable to get a handle on your tax planning early to avoid costly mistakes. In this blog, we shall study some strategies so that your small business can streamline tax preparation and minimize stress. But first, we shall understand some important changes this tax season brings for small business owners.

Important Changes for the 2025 Tax Season

- Potential Expiration of QBI Deduction:

- The 20% Qualified Business Income (QBI) deduction may expire at the end of 2025.

- If not extended by Congress, small business taxes could increase in 2026.

- IRS Adjustments for Inflation:

- Tax brackets, standard deductions, and some tax credits (e.g., Earned Income Tax Credit) have been updated.

- These changes may impact tax liability and deductions.

While tax laws remain relatively stable in other areas, business owners should prepare for these potential modifications by reviewing their tax strategies now.

What Is a Tax Planning Service?

Tax planning services provide comprehensive solutions for preparing and filing your taxes with the IRS and state agencies. These services go beyond do-it-yourself tax software. This is because they handle the process for you, whether through in-person consultations or online platforms.

Who Benefits from Tax Planning Services?

As a small business owner, you too can benefit from tax planning services. These services are ideal for anyone seeking to save time or handle complex tax situations. Through these services, you can avoid the stress of managing taxes independently. Although preparing taxes yourself can save money, professional services can provide confidence and expertise. This is especially true for small businesses navigating complex and detailed financial requirements.

Read More: Benefits of Outsourced Professional Tax Preparation Services (2025)

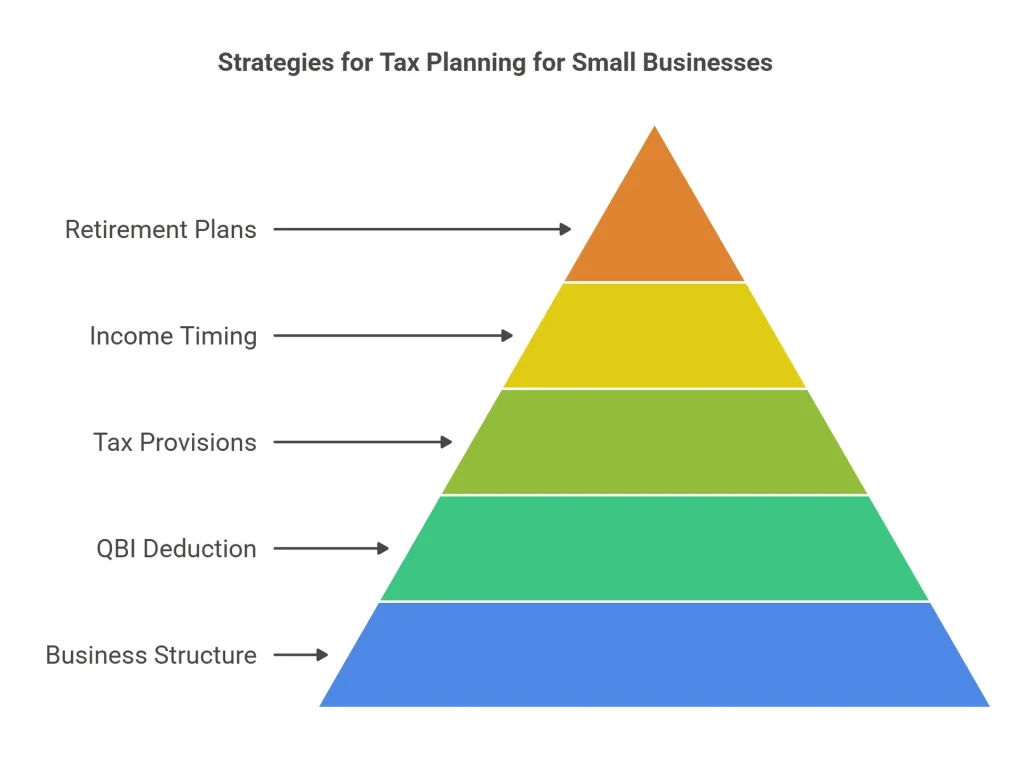

Strategies for Tax Planning for Small Businesses

Evaluate Your Business Structure

Your business structure impacts your tax obligations. If your current structure no longer suits your needs, consider options such as filing Form 8832 to elect a more advantageous status. Since tax rates and deductions are potentially changing in 2026, reviewing your structure now could help you plan for the future.

Leverage the QBI Deduction (Before It Expires)

The Qualified Business Income (QBI) deduction allows eligible business owners to deduct up to 20% of their income. Since this deduction is set to expire after 2025, business owners should take full advantage of it while they can. If the deduction is not extended, tax bills could increase in 2026. This means it is necessary to plan early to avoid any hitches.

Read More: Optimizing Tax Preparation for U.S. Accounting Firms in 2025

Take Advantage of Temporary Tax Provisions

Temporary provisions, like enhanced deductions for donated inventory, remain beneficial. Businesses donating inventory, such as food, may be eligible for higher deductions, easing the financial burden of unsold goods.

Manage Income Timing

Consider deferring income or accelerating expenses to align with a lower tax bracket or avoid higher tax rates in the future. For cash-based accounting businesses, this flexibility can provide significant tax savings.

Contribute to Retirement Plans

Establishing or contributing to retirement plans can lower taxable income while providing long-term benefits. Options like 401(k) plans or SEP IRAs are viable strategies, even if set up close to tax deadlines.

Simplify Your Tax Planning with KMK Ventures

For many business owners, tax season can feel overwhelming. KMK Ventures is here to simplify the process, offering expert guidance to help you save time and maximize your financial outcomes.

With personalized support and access to the best tools and strategies, KMK Ventures ensures your small business stays on track with tax compliance and planning. Let us help you navigate the complexities of tax season and achieve your financial goals.

Are You Unsure Of How To Submit Your Taxes? Bring Your Problems To Kmk Ventures And Leave The Solution

Tax time Those two words may be terrifying to many of us, especially if it’s our first time managing the complexity of tax planning for small businesses. However, if you work with KMK Ventures, preparing your business taxes doesn’t have to be a nightmare.

Tax planning for small companies may save time and maximize savings when it comes to filing taxes with the appropriate tax consultant. When it comes to choosing the best tax solution for you, the level of detail in your organization makes all the difference. KMK Ventures examines some of the greatest tax service choices available to assist you in making the best decision for your company.

USA:

651 N Broad St Suite 205, Middletown, DE 19709, USA

Phone: 310-362-2511

India:

300, Sankalp Square-3B

Sindhu Bhavan Marg,

Ahmedabad, Gujarat 380058

For Career: 91-98240-42996

Developed by Bluele | Copyright © 2025 | KMK Ventures Private Limited. | All Rights Reserved