Breakeven Analysis: The Complete Guide to Cost-Volume-Profit Analysis

Knowing how your business is doing financially is vital, and with KMK Ventures, we realize clarity begins with figures. Breakeven analysis is a valuable tool that can help you crack the code of how your costs, sales volume, and profitability are linked, making it a must-have in every visionary business leader’s toolkit.

Why Breakeven Analysis is Important for KMK Ventures Clients

At KMK Ventures, we are your outsourced tax and accounting department, working with companies in various industries to deliver customized financial information and solutions. Breakeven analysis is central to strategic decision-making, whether introducing a new product, contemplating expansion, or looking for increased efficiency.

What Is Breakeven Analysis?

Breakeven analysis finds the point at which your total revenues are equal to your total costs- your business pays for all expenses but hasn’t yet made a profit. For our customers, that means understanding exactly how many units you need to sell or how much revenue you need to bring in before you realize profits.

The KMK Method: Segmenting the Building Blocks

- Fixed Costs: Consider your office rent, employees’ salaries, or technology expenditures that do not vary with your sales volume.

- Variable Costs: These change with your business activity, e.g., materials or direct labor.

- Contribution Margin: The amount between your selling price and variable cost per unit illustrates how much each sale adds to paying for fixed costs.

Our KMK Ventures team utilizes cutting-edge technology and extensive industry expertise to assist you in precisely identifying and assigning these costs, making your breakeven analysis both accurate and actionable.

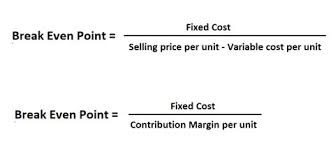

Calculating Your Breakeven Point

This is the formula our professionals use and illustrate for clients:

For example, if your fixed costs are $20,000, your product sells for $100, and your variable cost per unit is $60, you’ll need to sell 500 units to break even.

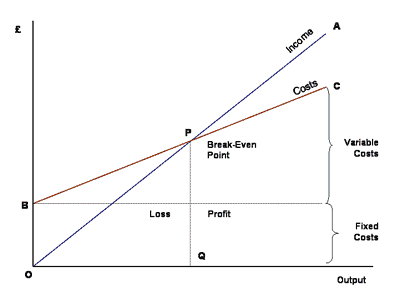

Graphical Method

Plot total revenue and total cost lines on a graph. Their intersection is the breakeven point. The total revenue line begins at zero, and the total cost line starts at the level of fixed costs (since these are paid whether anything is sold or not)

Cost-Volume-Profit (CVP) Analysis: Beyond the Fundamentals

Breakeven analysis is only the starting point. At KMK Ventures, we incorporate CVP analysis into your financial plan, assisting you:

- Establish best-selling prices

- Forecast income statements and budgets

- Assess new product launches or phase-outs

- Simulate the effect of cost savings or investments

- Optimize product mix for highest profitability

This comprehensive method enables you to make sound decisions, supported by actual figures and professional advice.

Practical Applications

- Pricing Strategies: CVP analysis indicates how various prices influence the breakeven point and profitability, informing competitive but profitable pricing.

- Production Planning: Determines minimum production levels required for profitability and aids capacity planning.

- Cost Management: Indicates which costs have the most significant effect on the breakeven point, allowing cost-cutting efforts to be prioritized.

- Product Mix Decisions: Indicates which products contribute most effectively to fixed cost coverage and profit generation.

How can break-even analysis help in identifying potential financial risks

Break-even analysis is helpful in ascertaining possible financial threats to a business. Determining the minimum sales volume needed to meet all fixed and variable expenses gives a definite line below which the firm would be operating at a loss. Information of this type is essential for a variety of reasons:

- Risk Assessment: A high break-even point indicates higher financial risk since the company needs to make significant sales to avoid losses. On the other hand, a low break-even point reflects lower risk since the company can recover its costs through fewer sales.

- Scenario Planning: Break-even analysis enables companies to simulate “what-if” scenarios, for example, a change in costs, price, or sales volume. This allows managers to forecast the effect of unfavorable conditions (e.g., rising costs or declining demand) and to create contingency plans to counter such risks.

- Cost Structure Insights: By distinguishing between fixed and variable costs, break-even analysis identifies the costs with the most significant effect on profitability. This allows for focused cost management and determines the areas where cost savings would reduce risk.

- Investment Choices: Before making new investments, like releasing a product or increasing operations, break-even analysis assists in calculating if projected sales are adequate to support increased costs, averting risky or loss-making businesses.

- Monitoring of Performance: Comparative analysis of projected sales and break-even point frequently enables companies to identify early indicators of financial difficulty and correct this before losses increase.

Read Also: Rolling Forecasts: Everything about Continuous Financial Planning

When to Use Breakeven Analysis

- Launching a new product or service

- Expanding or scaling operations

- Providing discounts or promotions

- Analyzing investments in equipment or facilities

- Strategic decisions regarding product lines or prices

Limitations of Breakeven and CVP Analysis

- Makes linear assumptions about cost, volume, and profit relationships, which might not be true in dynamic or complicated markets

- Fixed and variable costs can vary at various levels of production

- Does not consider qualitative factors and external market conditions

Why KMK Ventures?

With more than 475 CPAs and chartered accountants, KMK Ventures delivers experience, precision, and customer-focused care with every engagement. Our pledge to quality, data protection, and state-of-the-art technology means your breakeven analysis and financial planning are in capable hands.

Ready to Maximize Your Financial Strategy?

Breakeven and CVP analysis are not numbers- they’re the map to profitable and sustainable growth. At KMK Ventures, we don’t simply do the numbers; we transform them into actionable recommendations dedicated to your business objectives. Let’s unlock your business potential. Schedule a consultation with our professionals at KMK Ventures and find out how strategic financial analysis can propel your success.

Chandni Lakdawala is a chartered accountant with an MBA in business management. With six years of experience in accounting, taxation, and auditing, she currently works at KMK Ventures, a company that provides outsourcing services to businesses in the USA. At KMK Ventures, Chandni helps U.S.-based companies manage their financial records, ensuring accuracy and compliance with financial regulations. Her role involves overseeing accounting processes and providing insights to support business decisions. Chandni is committed to delivering high-quality financial services and continuously seeks ways to improve processes for the benefit of her clients.

Chandni Lakdawala is a chartered accountant with an MBA in business management. With six years of experience in accounting, taxation, and auditing, she currently works at KMK Ventures, a company that provides outsourcing services to businesses in the USA. At KMK Ventures, Chandni helps U.S.-based companies manage their financial records, ensuring accuracy and compliance with financial regulations. Her role involves overseeing accounting processes and providing insights to support business decisions. Chandni is committed to delivering high-quality financial services and continuously seeks ways to improve processes for the benefit of her clients.

Let’s Take Our Conversation Ahead

KMK is a top outsourced accounting and tax service provider. We offer end-to-end accounting and tax services for small to mid-sized businesses, with a team of 1000+ professionals, including certified public, chartered, and staff accountants.

USA:

651 N Broad St Suite 205, Middletown, DE 19709, USA

Phone: 310-362-2511

India:

300, Sankalp Square-3B

Sindhu Bhavan Marg,

Ahmedabad, Gujarat 380058

For Career: 91-98240-42996

Developed by Bluele | Copyright © 2026 | KMK Ventures Private Limited. | All Rights Reserved